SBI has informed

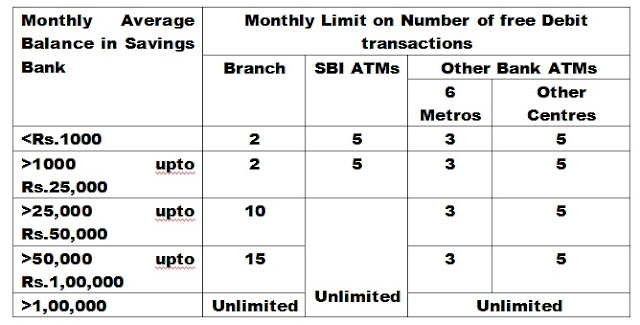

that the charges for cash withdrawal at branches beyond the permitted

free withdrawals are Rs.50/- + Goods and Service Tax (GST) per

transaction. State Bank of India (SBI) has informed that the charges are levied by them beyond number of free transactions are as under:-

With substantial investment in infrastructure and technology, cash outgo to other banks for ATM transactions and cost of servicing Pradhan Mantri Jan Dhan Yojana (PMJDY) / Basic Savings Bank Deposit (BSBD) /Financial Inclusion (FI) accounts with RUPay Debit Card, it becomes imperative for the Bank to find a way out to recover at least a part of the cost. The charges are levied for the cost involved in handling the transaction and the attendant work.

Further, SBI has informed that the charges being levied for cash withdrawals at ATMs beyond the permitted free withdrawals are as under:

i) Rs.10/- + GST per transaction at SBI Bank ATMs and

ii) Rs.20/- + GST at other Bank ATMs.

This Government has received some complaints from public including Hon’ble Members of Parliament regarding to impose penalties on customers for not keeping minimum balance by banks. Reserve Bank of India (RBI) has informed that terms and conditions for operating a saving bank account including minimum balance requirements are decided by Boards of individual bank. These are not fixed by RBI.

With substantial investment in infrastructure and technology, cash outgo to other banks for ATM transactions and cost of servicing Pradhan Mantri Jan Dhan Yojana (PMJDY) / Basic Savings Bank Deposit (BSBD) /Financial Inclusion (FI) accounts with RUPay Debit Card, it becomes imperative for the Bank to find a way out to recover at least a part of the cost. The charges are levied for the cost involved in handling the transaction and the attendant work.

Further, SBI has informed that the charges being levied for cash withdrawals at ATMs beyond the permitted free withdrawals are as under:

i) Rs.10/- + GST per transaction at SBI Bank ATMs and

ii) Rs.20/- + GST at other Bank ATMs.

This Government has received some complaints from public including Hon’ble Members of Parliament regarding to impose penalties on customers for not keeping minimum balance by banks. Reserve Bank of India (RBI) has informed that terms and conditions for operating a saving bank account including minimum balance requirements are decided by Boards of individual bank. These are not fixed by RBI.

Post a Comment